Anyone with earned income can open a Traditional or Roth IRA. The tax benefits and contribution limits depend on your income and tax-filing status.

Your flexible path to retirement savings

Whether you're looking to open a Traditional or Roth IRA, Carry provides the tools to help you save on taxes, manage your wealth, and invest flexibly—including alternative and crypto investments.

The benefits are (almost) endless

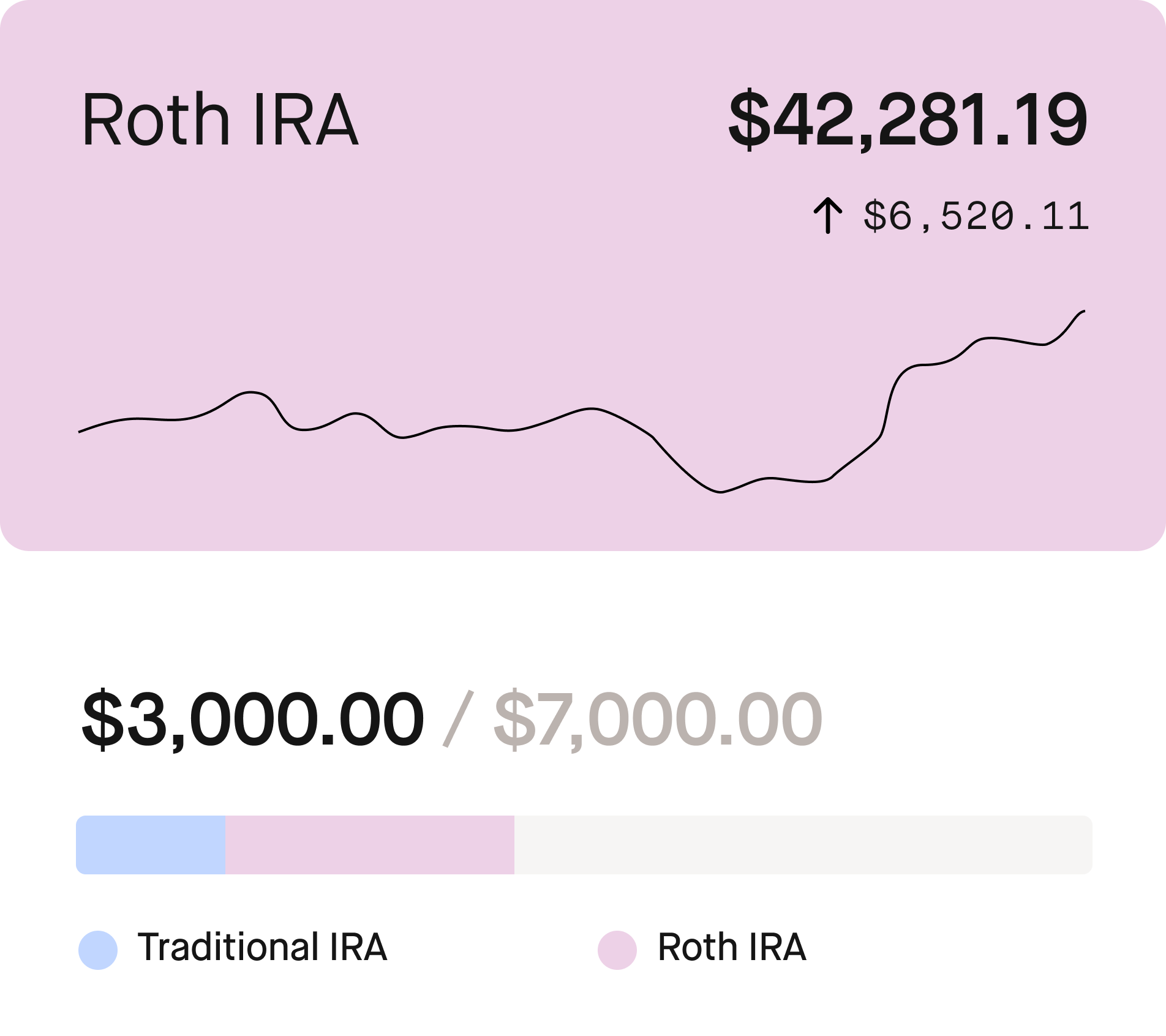

Image is hypothetical.

Image is hypothetical.

Roboadvisor

Stocks & ETFs

Automatic recurring deposits

Roth and Traditional IRAs

Trade with no commissions

Backdoor Roth conversion

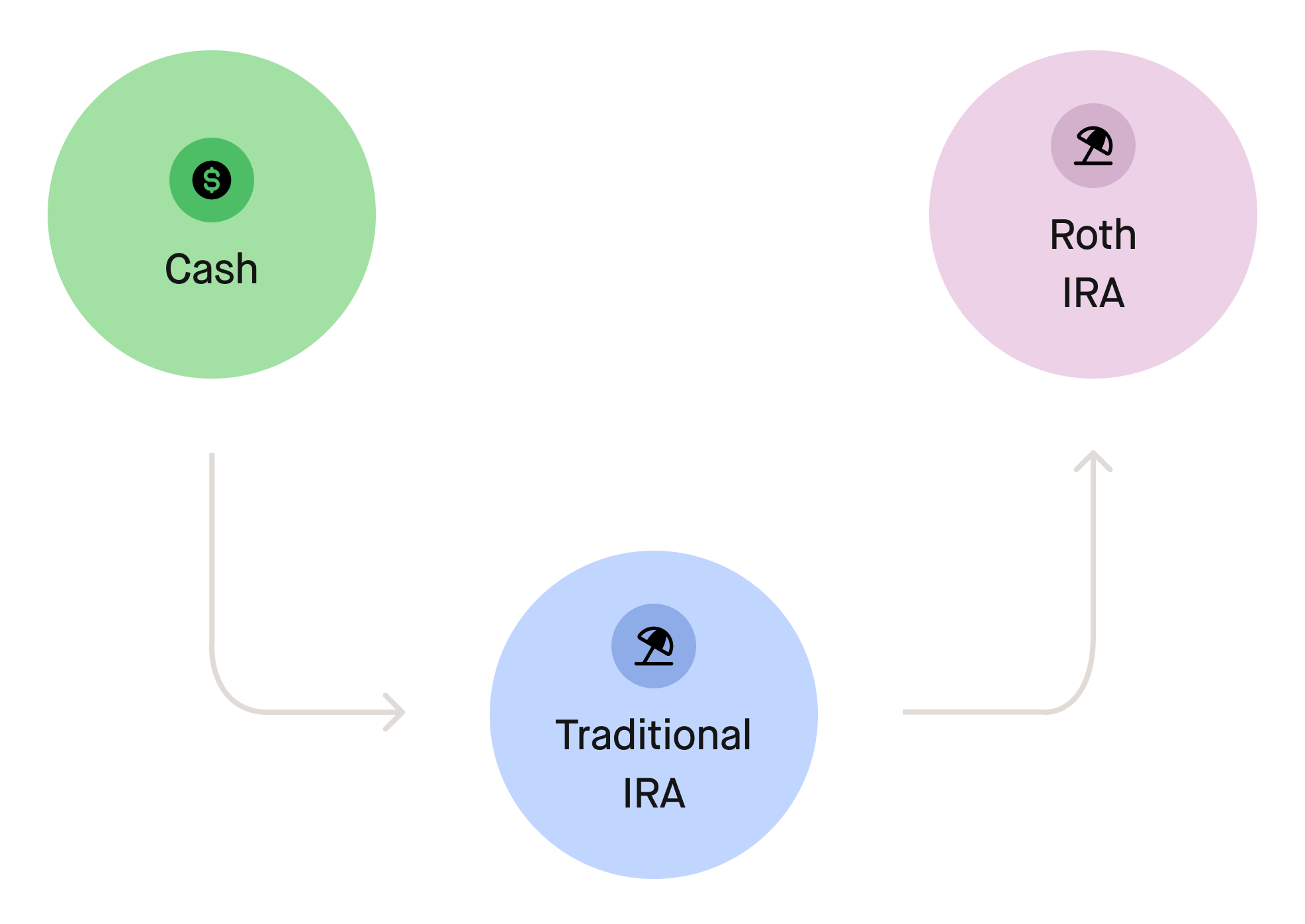

Income too high for Roth? Do a backdoor conversion

If you make more than the income limit for Roth ($146,000 for single filers and $230,000 for joint filers in 2024), you may be eligible for a backdoor Roth conversion.

The Carry platform lets you do this in just a few clicks, and handles the conversion automatically, bringing you one step closer to potential tax-free growth.

Image is hypothetical.

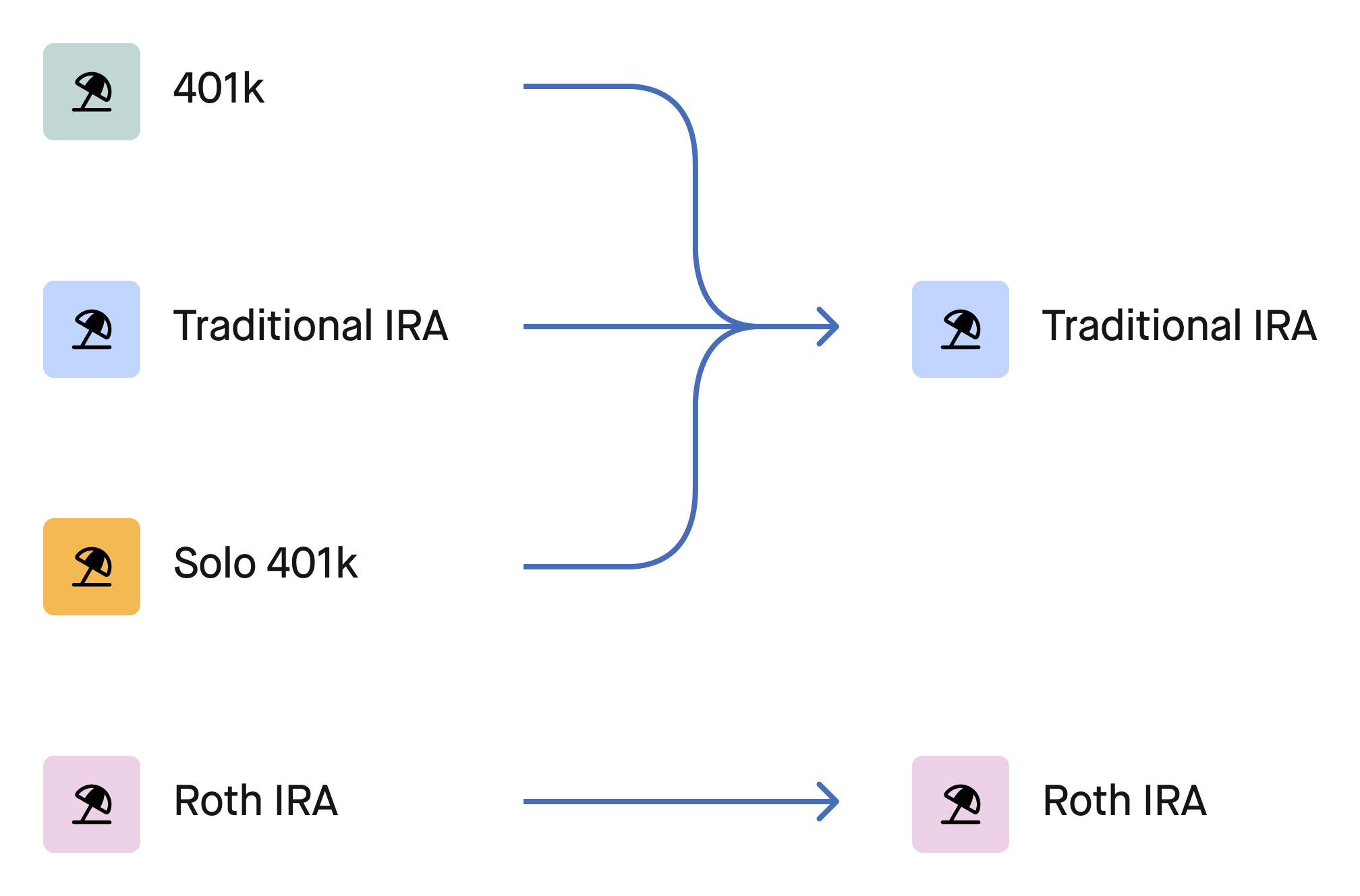

Image is hypothetical.

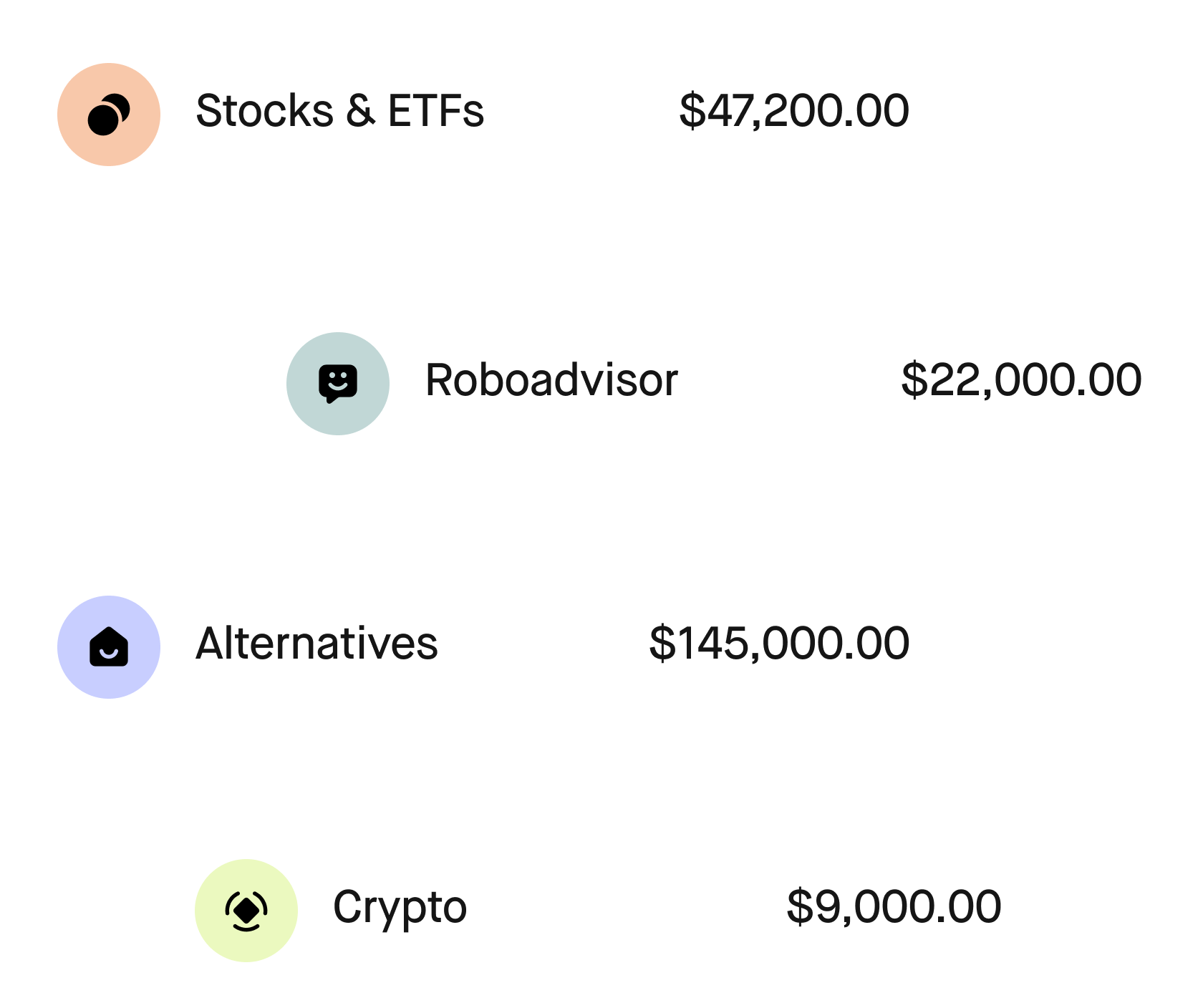

Invest in (almost) anything you like

With Carry IRA, diversify your portfolio all in one place. Invest in popular equities (including popular funds from Vanguard), use our Roboadvisor for hands-off investing, or explore alternative assets like real estate, private equity, and crypto.

Disclosure: Investment advisory services offered by Carry Advisors, an SEC registered investment advisor. Bank and Trust accounts for alternative assets are not advised.Looking to switch? Simple.

If you already have a Traditional or Roth IRA, our goal is to make rolling it over to Carry simple. Roll over cash, equities, alternatives, or a combination of all. *

Real customers who made the switch

"Checks every box, and supports Roth Contributions."

"Very very impressed with Carry. Checks every box and supports Roth contributions to Solo 401(k), including mega backdoor Roth and even has self-directed IRAs for those who want that. Great resources. Clean/easy-to-use website. Great support."

Ryan Odom

Entrepreneur

These are real testimonials from real customers, who have not been compensated.

Discover why our customers trust Carry

These are real testimonials from real customers, who have not been compensated.

Get Started with Carry

Basic Plan

Great for maximizing retirement savings and tax-saving strategies.

Pro Plan

Everything in the Basic Plan, plus:

Best if you’re self-employed and want access to further investment types.

VIP Plan

Everything in the Pro Plan, plus:

Ideal for business owners earning $200k+ in annual profit.

Questions before joining?

Who is eligible to open an IRA with Carry?

Can I roll over my existing IRA to Carry?

Yes! If you have an IRA with another provider, you can easily roll it over to Carry (our goal is to make that process super simple, straightforward, and we'll be there to help you along the way).

What's the difference between a Traditional IRA and a Roth IRA?

With a Traditional IRA, you defer taxes until retirement. With a Roth IRA, your contributions are taxed upfront, but your withdrawals in retirement are tax-free.

Can I invest in alternative assets with a Carry IRA?

Yes! Carry allows you to invest in a wide range of assets, including real estate, startups, and private equity, with self-directed investing options.

Disclosure: Investment advisory services offered by Carry Advisors, an SEC registered investment advisor. Bank and Trust accounts for alternative assets are not advised.What's the Backdoor IRA?

A Backdoor IRA is a strategy that allows high-income earners to contribute to a Roth IRA by first contributing to a Traditional IRA and then converting it to a Roth IRA. Carry makes this process simple and efficient (learn more here).

Are there any additional fees?

Carry offers a simple flat fee. Learn more about our pricing here.

Is my IRA with Carry protected?

Yes, your funds have multiple layers of protection through both insurance coverage and regulatory safeguards. Depending on the investment account type, your investment will be covered by either FDIC, SIPC or other regulatory safeguards provided by our custodian partners. Learn more here.

At Carry, we take the safety and security of your assets very seriously. That's why we partner only with reputable, well-established custodians to hold your funds. Carry does not custody or hold any funds. The specific safeguards and protections depend on the type of custodian:

Bank Custodians (Grasshopper Bank, N.A.)

Current Carry accounts custodied with Bank Custodians

- Solo401k Alternative Investing

When your funds are custodied at our partner bank Grasshopper Bank, N.A., they are covered by FDIC insurance. The Federal Deposit Insurance Corporation (FDIC) is an independent federal agency that protects you against the loss of your insured deposits if an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the United States government. Carry is a technology company, not a bank or member FDIC.

Broker-Dealer Custodians (DriveWealth, LLC)

Current Carry accounts custodied with Broker-Dealer Custodians

- Solo401k Stocks & ETFs

- IRA Stocks & ETFs

- Brokerage Accounts

- Cash

Trust Company Custodians (American Estate & Trust)

Current Carry accounts custodied with Trust Companies

- IRA Alternative Investing

- IRA Crypto Investing

When your funds are held at our trust company partner, American Estate & Trust (AET), they are not FDIC insured as AET is not a bank. However, AET is regulated by the Nevada Financial Institutions Division and is subject to rigorous capital requirements, regulatory oversight and periodic examinations. Your assets are held separate from AET's corporate assets and are not used in the conduct of AET's business.

AET accounts are also protected by their errors and omissions insurance policy which covers potential losses resulting from negligence, errors, or other wrongful acts committed by AET employees in the course of their work. This insurance provides an extra layer of protection for your assets. It's important to note that none of these insurances protect against the decline or complete loss of value of your securities, or any fraud or mismanagement associated with your alternative investments. All investing involves risk, especially investing in alternative assets.