Retirement Accounts for Business Owners

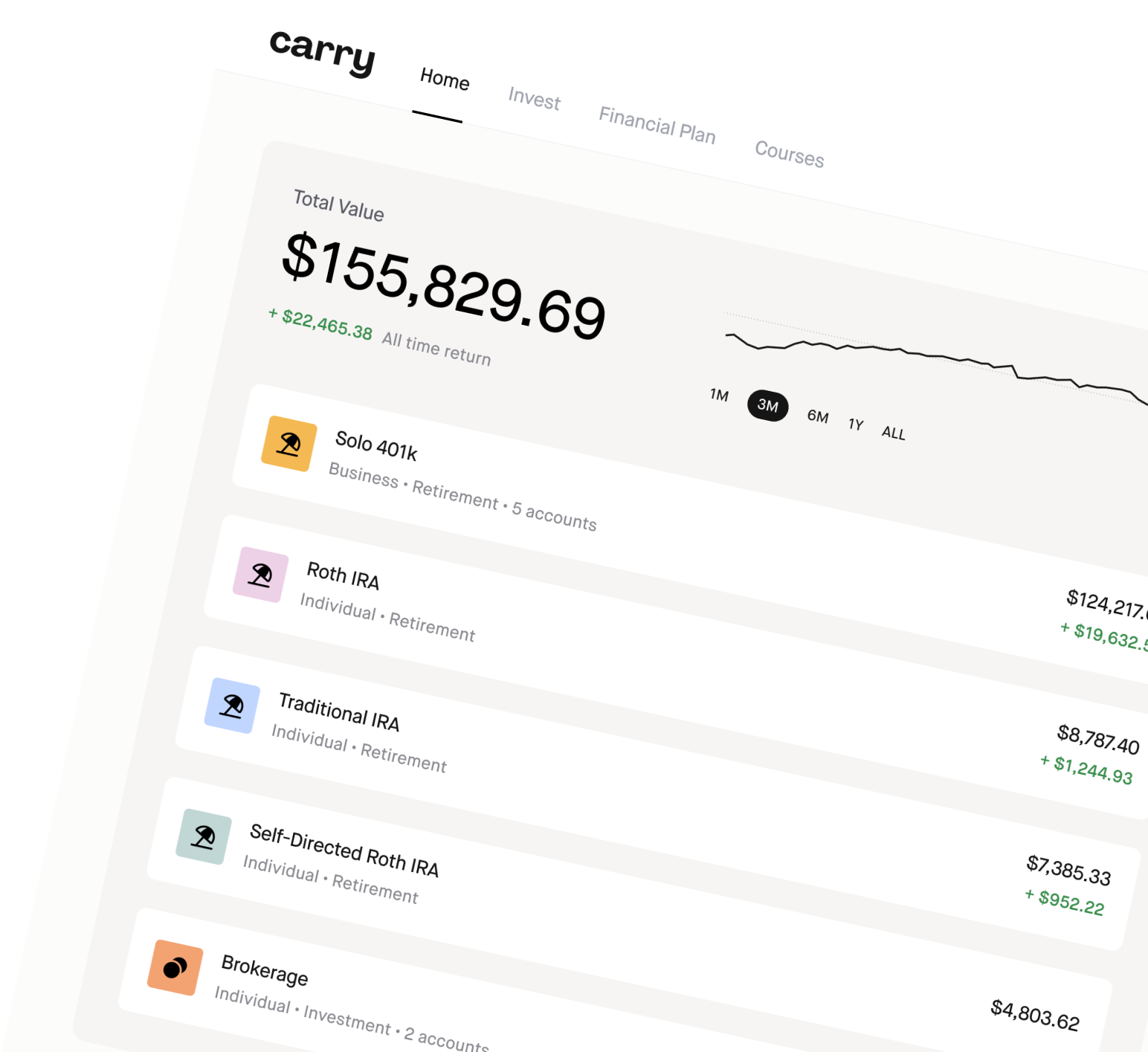

Carry is an all-in-one platform for retirement accounts for business owners. Set up a Solo401k, Traditional IRA, and more to reduce your tax bill. Get started for $29 for your first year (instead of $299).

Perfect for your S-Corp with Lettuce

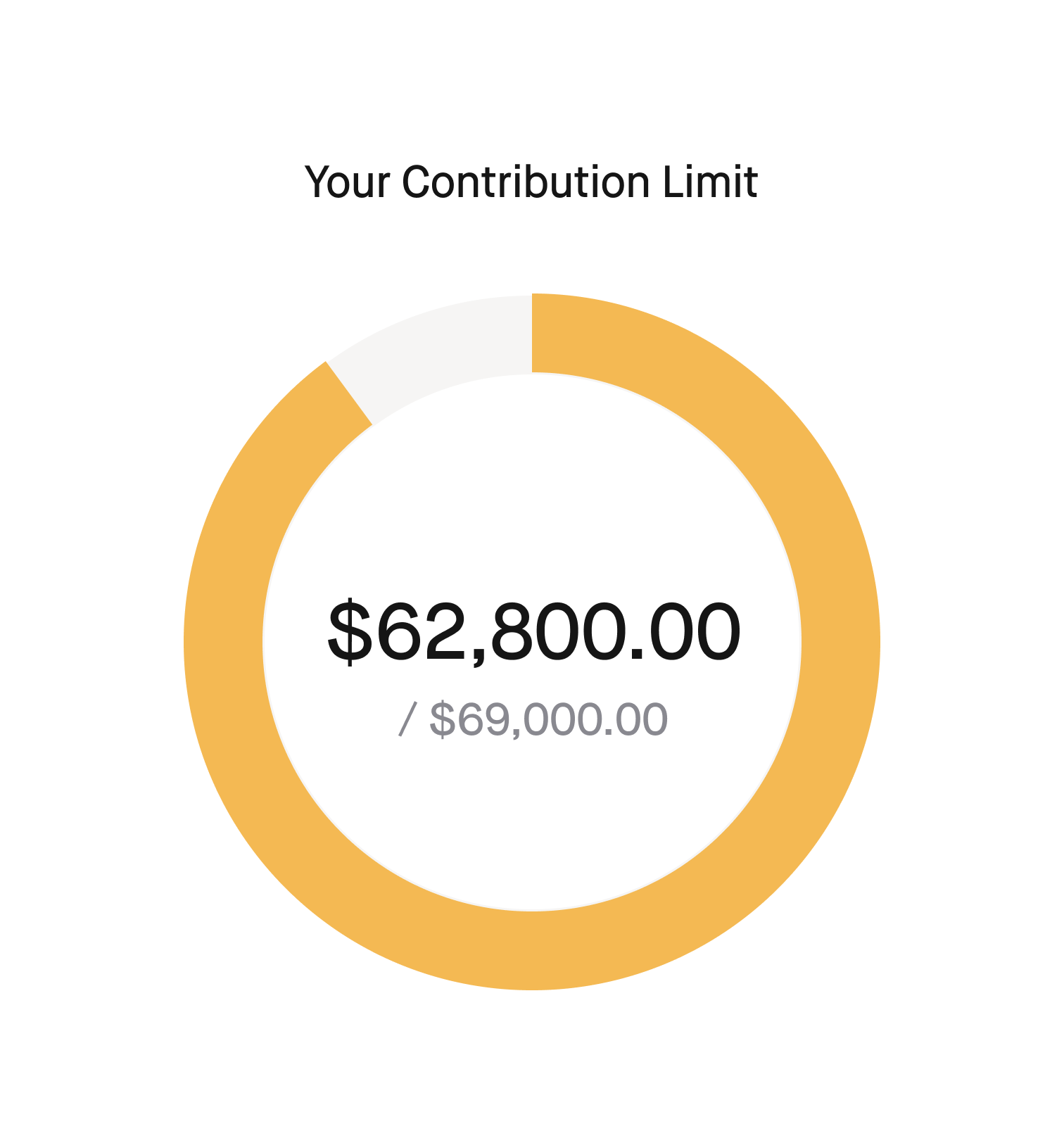

Carry can support you regardless of if you are a sole-prop, LLC, S-Corp, C-Corp, LLP, or anything else. Your legal entity only impacts how your contributions are calculated, which we also help you with through our proprietary Contributions Calculator.

We’ve taken the ever-evolving and complicated American tax code and simplified it into step-by-step questionnaires that explain your choices and empower you to make the right decisions.

Solo401k: The most powerful retirement account in America

If you own a business with no employees or have a side hustle, you're eligible for a Solo 401k. Dollar for dollar, this beats out every retirement account in size and flexibility.

A modern investment platform built for long-term growth⑄

We’ve built a powerful brokerage into every Carry account, making it easy to invest in stocks, ETFs, and mutual funds—all in one place.

Not sure where to start? Roboadvisor invests automatically based on your goals and financial profile, so you can stay hands-off.

Just set up a recurring contribution, and we’ll handle the rest—rebalancing, reinvesting, and keeping your investments on track.‡

“I've put away more money in the last 2 years via Carry than the last 5 years combined”

"I've not only put away more money in the last 2 years via Carry than the last 5 years combined (solo401k FTW!), I've also learned so much about the tax code.

As they say, the only partner you'll have on every business is the US federal government. Learn how to optimize your share."

- Matt Brezina

Entrepreneur, Investor (and Carry Customer!)

Find the perfect fit for your financial goals

Get started with Carry’s Basic Annual plan for $29 for the first year (instead of $299). After the first year, the Basic Annual plan will renew at the regular price.

You guys really nailed the educational component here - impressive work. UX is fantastic.

I've been a customer for just over a year. Great UX compared to legacy products out there. Thanks for building this!

Questions before joining?

Why does Carry have an upfront fee?

Can I move my existing Solo 401k or IRA to Carry?

For Solo 401k: Just set up your Carry account and select the option to restate your plan.

For IRAs: Simply create a new IRA after setting up your Carry account and transfer your assets

Have questions about the process? We're here to help, just reach out!

Can I sign up for a Solo 401k as a Sole Proprietor or do I need an LLC?

No LLC? No problem! You can use your SSN instead of an EIN to open a Solo 401k with Carry.

Who can set up a Solo 401k?

- You're earning self-employed income as a business owner, freelancer, creator, or side-hustler (any business entity type is eligible, including multi-partner LLCs)

- You have no full-time employees (outside of your spouse)

- You're a U.S. resident

Feel free to reach out to us if you have any questions!

Are there any other fees with Carry?

- Any underlying investment fees (for ex. If you buy an ETF, the underlying fund expense ratio; this goes to the fund and not Carry)

- Certain transaction fees charged by our custodians, like initiating an outgoing ACH or purchasing Cryptocurrency

- Managed investment accounts including Smart Yield and Roboadvisor are subject to annual advisory fees of 0.20% (currently waived through December 31, 2025)

For more information, you can refer to carry.com/fees.